Exits need to be based on other types of candlestick patterns or analysis. During a trading day, when the bulls gain confidence after a long downtrend and the bullish trend is too strong for the buyers to resist, the inverted hammer is formed. Here are the key takeaways you need to consider when using the inverted hammer candlestick pattern. When you add the RSI indicator to your charting platforms, you’ll be looking for a crossover around the 30 level and at the same time, the inverted hammer candlestick appears. This example illustrates how traders can use the inverted hammer signal to catch reversals out of downtrends and trade in the direction of a new uptrend.

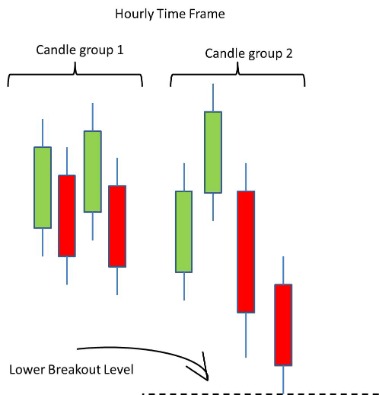

For example, an inverted hammer happening after a downtrend in the 60-minute chart might seem to tick all boxes, but be part of a bigger trend in the 240-minute bars. We research technical analysis patterns so you know exactly what works well for your favorite markets. Unfortunately, this setup has a negative edge, and traders will lose money using this trading strategy. It is important to note that neither of these two patterns is a direct trading signal, but a tool which generates a sign that the price action may reverse as a balance shift is occurring. Both are reversal patterns, and they occur at the bottom of a downtrend.

robot trader forex

The appearance of the inverted hammer candle near support provides the basis for the bullish reversal. Traders can place stops below the support line to limit downside risk in the event the market moves in the opposite direction. The price’s ascent from its session low to a higher close suggests that a more bullish outlook won the day, setting the stage for a potential reversal to the upside. Traders typically utilize price or trend analysis, or technical indicators to further confirm candlestick patterns. As you might already know, many candlesticks could be identified as bullish reversal patterns in the market.

- When you add the RSI indicator to your charting platforms, you’ll be looking for a crossover around the 30 level and at the same time, the inverted hammer candlestick appears.

- TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools.

- To some traders, this confirmation candle, plus the fact that the downward trendline resistance was broken, gave them a potential signal to go long.

- Check out our sponsorships with global institutions and athletes, built on shared values of excellence.

- One great and often overlooked aspect of the markets is the time element.

- The inverted hammer candle has a small real body, an extended upper wick and little or no lower wick.

At one point, the inverted hammer was created as the bulls failed to create a hammer, but still managed to press the price action higher. Although the session opens higher than the recent lows, the bears push the price action lower to secure new lows. However, the bulls surprise them with a press higher to secure the bullish (green) close. At this point, it is clear that the balance has changed in favour of the buyers, and there is a strong likelihood that the trend direction will change. Similar to a hammer, the green version is more bullish given that there is a higher close.

From beginners to experts, all traders need to know a wide range of technical terms. In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Elearnmarkets (ELM) is a complete financial market portal where the market experts have taken the onus to spread financial education.

Watch FXOpen’s September 4 – 8 Weekly Market Wrap Video

When we start analyzing the stocks using this https://g-markets.net/, there are certain aspects that we should look for. Second, the upper shadow must be at least two times the size of the real body. Third, the lower shadow should either not exist or be very, very small. Fourth, the real body should be located at the lower end of the trading range. The color of this small body isn’t important, though (as you’ll see below) the color can suggest slightly more bullish or bearish implications. Below, is a GBP/USD chart exhibiting a downtrend that consolidates at support.

Silver Forecast: Looking to Turn Things Around – DailyForex.com

Silver Forecast: Looking to Turn Things Around.

Posted: Mon, 21 Aug 2023 07:00:00 GMT [source]

It is actually almost the same chart, it’s just that this sequence occurred a bit later. To master the hammer and the inverted hammer, as well as other technical indicators and formations, you may want to consider opening a demo trading account, which you can access here. This way you will prepare yourself before you start risking your own capital. Unlike the hammer, the bulls in an inverted hammer were unable to secure a high close, but were defeated in the session’s closing stages. Still, the mere fact that the buyers were able to press the price higher shows that they are testing the bears’ resolve. Similarly, the inverted hammer also generates the same message, but in a different manner.

Is an Inverted Hammer the same as a Shooting Star?

They enter the market at the close of the inverted hammer candle and place a stop loss at the support zone or below the bar. The hammer candlestick pattern is a one-bar bullish reversal pattern. The only difference between the hammer candlestick pattern and the inverted hammer is that the wicks are reversed. Multiple candlestick patterns are often confused with the inverted hammer pattern.

In fact, there are many candlestick patterns that are commonly used by traders, and one of those is the inverted hammer. After identifying the formation, wait for confirmation signals, such as a higher closing price in the next candlestick, to validate the potential bullish reversal. Once confirmed, you may enter a long position above the high of the bar while placing a stop loss below the low of the candlestick to manage risk. Traders may set a target price or use trailing stops to secure profits as the market moves favourably. After a subsequent downtrend, the inverted hammer provides a buying opportunity that aligns with the support level.

Psychology of the Hammer

Candlestick patterns represent the movement of prices in a candlestick chart. It helps crypto traders try to predict a crypto asset’s future price direction. An inverted hammer candlestick inverted hammer candlestick pattern is one of the patterns on such charts. The hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal.

- It’s really one of those go-to solutions that we try on every strategy, in an attempt to improve performance.

- This confirmation shows that the bullish reversal probably has taken place.

- In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives.

- It has a long lower wick, small real body, and little to no upper wick.

- Unfortunately, this setup has a negative edge, and traders will lose money using this trading strategy.

- Again, you can either wait for the confirmation candle, or open the trade immediately after the inverted hammer is formed.

The pattern suggests that sellers have attempted to push the price lower, but buyers have eventually regained control and returned the price near its opening level. We looked at five of the more popular candlestick chart patterns that signal buying opportunities. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. Such a downtrend reversal can be accompanied by a potential for long gains. That said, the patterns themselves do not guarantee that the trend will reverse.

How does an inverted hammer form?

Specifically, it indicates that sellers entered the market, pushing the price down, but were later outnumbered by buyers who drove the asset price up. Importantly, the upside price reversal must be confirmed, which means that the next candle must close above the hammer’s previous closing price. To answer the question, there are a lot of single candlestick patterns in the trading world, but only a few offer signals worth considering (thankfully).

Although the bulls step in and rally the prices up briefly, they’re weak and the price is ultimately pushed very low, closing near to where it opened. To confirm that a bullish reversal will occur, check for a higher open during the next trading period. The inverted hammer can also be used to identify retracements in the market. The EUR/USD chart below highlights the inverted hammer (in blue) which signals renewed bullish momentum.

One great and often overlooked aspect of the markets is the time element. Different patterns and strategies may work very different depending on the time of day, day of week, day of month, or any other measure. In addition to that, it’s important to use the inverted hammer with a market and timeframe where it works well! This is a major difference to the previous state of the market, where sellers dominated the scene. The increased confidence of the buyers becomes the end for the downtrend, and a bullish trend emerges shortly thereafter. Every candlestick tells a unique store about the market and how the buyers and sellers interacted.

How to Trade Forex Using the Inverted Hammer Candlestick Pattern – Strategies and Examples

The inverted hammer itself is not enough to ensure a bullish reversal. You need to see follow through buying pressure on the next candle for confirmation. Traders can go long, once the high of the inverted hammer candle is crossed, keeping the low of the inverted hammer candle as the stoploss.